China Titanium Alloy Materials Market Development History and Trend Analysis 2023: Market Size is Gr

Release time:2026-02-25 Strike:1024 Inquire Now

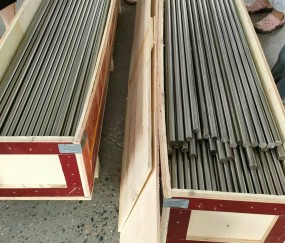

Titanium alloy refers to a variety of alloy metals made from titanium and other metals. Titanium is an important structural metal developed in the 1950s, and titanium alloys have high strength, good corrosion resistance and high heat resistance.In the 1950s and 1960s, the main focus was on the development of high-temperature titanium alloys for aero-engines and structural titanium alloys for airframes.

After entering the mature stage, titanium alloy materials will continue to play an important role and usher in a broader market prospect. In the future, with the continuous innovation of technology and the expansion of application fields, titanium alloy materials will continue to grow and become one of the important materials in more fields.

China's titanium alloy market size grew from 5.995 billion yuan in 2017 to 16.459 billion yuan in 2022, with a CAGR of 22.4%%. In the future, as the sales volume of titanium materials for aerospace is rising year by year, the amount of titanium alloys in the field of military and civil aircraft along with the upgrading of their respective products is a steady growth trend and the new demand brought about by the big cycle of upgrading and replacing military aircraft, the replacement of the old aircraft with the old aircraft and the launch of the new aircraft, the market for titanium alloys will reach 42.183 billion yuan in 2027, with a CAGR of 20.7% for the period 2022-2027.

Industry Policy

Lightweight is an important way to promote energy saving and emission reduction, carbon neutral, and achieve green development, and aluminum alloy with its lightweight application of cost and material advantages, in this process is still the focus of the development of the field, especially high-end aluminum alloy, there is import substitution of space, in the protection of China's material security environment, the development of the field of aluminium alloy policy state has also given a lot of support. For example, in 2022, the release of the "industrial sector carbon peak implementation programme" requires focusing on key processes, strengthening advanced casting, forging, welding and heat treatment and other basic manufacturing processes and the integration of new technologies and development, the implementation of intelligent, green transformation. Accelerate the promotion of anti-fatigue manufacturing, lightweight manufacturing and other energy-saving and material-saving processes.

Industrial Chain

The upstream of the aluminium alloy industry chain is the metal mining and smelting industry, which is mainly composed of bauxite mining, alumina refining, electrolytic aluminium production, and aluminium scrap recycling. After processing electrolytic aluminium (mainly casting and rolling), aluminium alloy castings, aluminium sheet and strip, aluminium profiles and other products are obtained; the downstream enterprises of the industry chain purchase aluminium processed materials which are widely used in the fields of construction, automobile, aerospace, machinery, electric power, electronics, packaging and so on.

Electrolytic aluminium is the direct raw material of aluminium alloy, due to the rapid development of China's construction industry, automobile, electric power and other industries in recent years, the market demand for electrolytic aluminium continues to increase, China's production of electrolytic aluminium has also been growing steadily, but subject to strict control of production capacity under the concept of "double carbon" in recent years, China's production of electrolytic aluminium production growth rate has gradually slowed down. According to the data show that in 2022 China's electrolytic aluminium production of 40.214 million tons, a year-on-year growth of 4.4%.

-

How to Apply for BIS Certificate India

Here is a clear explanation in English on how to apply for a BIS...

-

Alloy28 Stainless steel with 28% Cr and 3% Mo

🔧 UNS N08028 Stainless Steel – Overview and ApplicationsUNS N080...

-

Exploring the Applications of Resistance Wire: From Industrial Heating to Electric Vehicles

Resistance wire is a specialized material widely used in various...

-

How to Caculate the Nichrome80 Temperature

We’re super stoked about our Nichrome 80 wire, a go-to for high-...