Nickel Price Trends in Q1 Of 2025

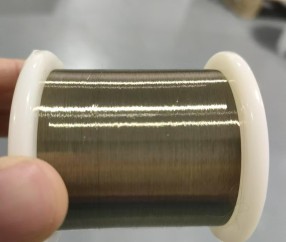

- Product Details

📈 Nickel Price Trends – Q1 2025 Overview

In the first quarter of 2025, nickel prices continued to face downward pressure, mainly due to global oversupply and weakening demand:

Price Range: Nickel traded between $15,000 and $16,500 per metric ton, with some resistance observed around $18,000.

Inventory Levels: Global inventory levels, particularly on the London Metal Exchange (LME), rose to the highest since 2021, reflecting persistent market surplus.

Demand Factors: Demand was weak from the stainless steel industry and the electric vehicle (EV) sector, where a shift toward lithium iron phosphate (LFP) batteries — which do not require nickel — reduced traditional consumption.

🔍 Main Factors Affecting Nickel Prices

1. Indonesia’s Production Policies

Indonesia, supplying over 50% of the world’s nickel, announced plans to cut its mining quota by nearly 40% in 2025. This move is aimed at stabilizing the market and supporting nickel prices.

2. Demand Shifts

Stainless Steel: Global stainless steel production remained sluggish, especially in China, putting downward pressure on nickel demand.

Electric Vehicles: The growing popularity of LFP batteries, which do not use nickel, has impacted nickel’s role in the battery market.

3. Policy and Market Dynamics

New initiatives promoting sustainable and “green” metals could introduce price premiums for certified nickel products.

Changes in government policies, especially related to environmental standards and EV incentives, are likely to influence future nickel demand patterns.

📊 Nickel Market Outlook for 2025

While there is potential for short-term price rebounds if Indonesia’s production cuts are fully implemented, the overall market is expected to remain cautious. Oversupply remains a major concern, and nickel prices are likely to stay within a relatively stable range unless there are significant changes in production or a sharp recovery in global demand.

✅ Summary:

Nickel prices have been under pressure, driven by high supply and evolving market needs. Future pricing will depend heavily on production cuts, shifts in EV battery technology, and global economic recovery.

Would you also like me to create a brief forecast paragraph you could add at the end, like "Our company strategies to handle nickel price fluctuations..."?

It would sound even more professional on your site! 🚀